The incoming Trump administration could decrease the viability of the nascent U.S. hydrogen economy with changes in clean energy funding, trade, climate and environmental policies, according to legal and industry experts.

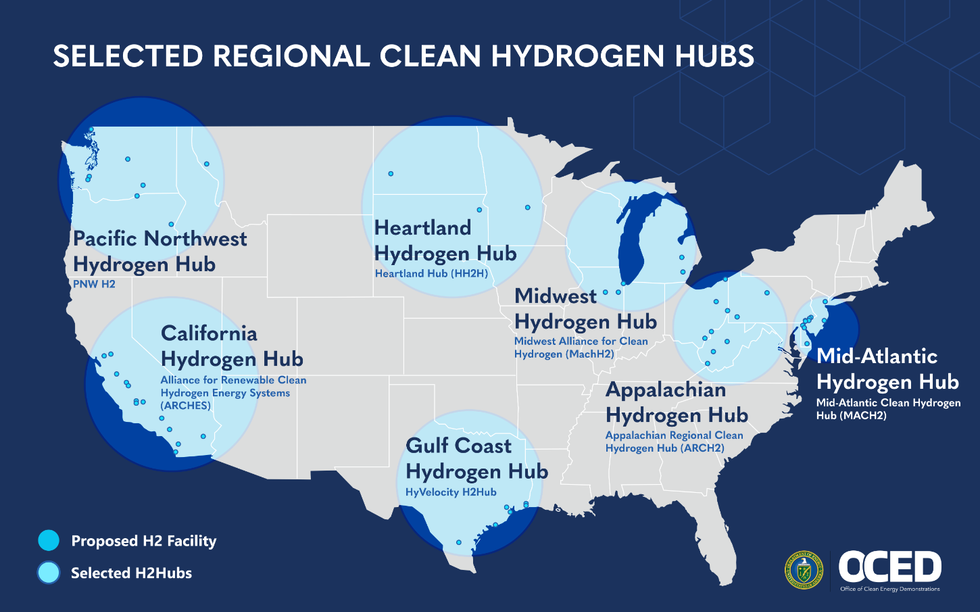

The Biden administration made a big bet on hydrogen — with seven proposed, federally funded hydrogen hub networks, an initiative born from the administration’s 2021 Bipartisan Infrastructure Law. The hubs are all still in early phases of development, however, the Department of Energy (DOE) has allocated $7 billion in federal funding for the hubs, which support the Biden administration’s objective of reaching net-zero carbon emissions nationwide by 2050 and achieving a 100% “clean” electrical grid by 2035.

The projects, which will use both renewable and fossil fuel energy to create hydrogen, have already faced criticism from community members and advocacy groups who say details of the projects remain hazy, public input is being planned after industry partners have already received millions of dollars in public funding, and communities don’t have agency in the decision-making.

While much remains uncertain with the upcoming Trump presidency, experts said it’s unlikely the projects would be abandoned entirely. However, the initiative could be harder to fund, less focused on slowing climate change – which could impact production sales to places with stricter environmental rules, like the EU – and deepen the lack of community engagement many advocates have denounced.

“I think there will be a lot of pressure from the oil and gas industry on the Trump administration to basically keep the hydrogen provisions but to make them more lenient and friendly toward fossil fuel interests,” Matt Lifson, an attorney with the Institute for Policy Integrity at the NYU School of Law, told EHN.

Policy shifts that could impact the the hydrogen hubs

The DOE has already provided some funding for five of the seven hubs — $131.7 million, with the Gulf Coast and Midwest hubs receiving funds most recently on November 20 — but much of the $7 billion earmarked for the hubs is set to be distributed over the next decade.

Any funding that hasn’t been distributed when Trump takes office could be reallocated through federal budget reconciliation, according to legal and policy experts. Reconciliation bills can’t be filibustered and the process has been used to pass at least 22 bills since the process was established in 1974, including the Biden administration’s 2022 Inflation Reduction Act (IRA).

“A lot will depend on the contracts the federal government has already signed with the hydrogen hub developers,” said Lifson. “Even if Congress changes the law, there could potentially still be a contractual claim the hubs could pursue for the money.”

Trump’s policies on clean energy tax credits could also impact the hubs. Trump has repeatedly called into question the Biden administration’s Inflation Reduction Act (IRA), which doled out clean energy tax credits over the past four years. Trump’s pick to head the Treasury Department Scott Bessent recently called the IRA a “doomsday machine for the budget.”

If Trump cuts tax credits for the industry, that means he would most likely get rid of a 10-year tax credit for hydrogen production established by the IRA but not yet finalized. The tax cut “has been a cornerstone for accelerating clean energy investments and job creation,” Katie Ellet, chief executive officer of ETCH, a decarbonization and hydrogen production company, and previous president of hydrogen energy and mobility for Air Liquide North America, told EHN.

“While the hydrogen market’s transition was underway before the IRA … the legislation significantly amplified this momentum,” Ellet added.

Before the recent election, the Biden administration promised to finalize the clean hydrogen production tax credit by the end of the year. However, the rule could be overturned under the Congressional Review Act, which allows Congress to overturn final rules issued by federal agencies within 60 days. If that happened, it would also bar “substantially similar legislation” from being passed in the future, so it’s unclear if the Biden administration will finalize the rule.

As currently written, the tax credits incentivize lower levels of carbon emissions in hydrogen production.

“Whether the Biden administration finalizes the rule and it gets repealed, or whether they don’t finalize it and the Trump administration proposes a new rule, it’s not hard to imagine the Trump administration issuing a final rule that’s extremely lenient toward emissions accounting,” Lifson said. “That would be very bad from a climate perspective.”

Trump’s final decision on the hydrogen energy tax credits will also influence markets. The EU is currently finalizing policies that will prevent it from buying hydrogen produced using fossil fuels rather than clean energy sources, and if the tax credit incentivizes the creation of hydrogen using fossil fuels, the U.S. could end up with a surplus.

“While the hydrogen market’s transition was underway before the IRA … the legislation significantly amplified this momentum.” – Katie Ellet, ETCH

In addition to the $7 billion in federal funds that have been set aside for the hubs, an estimated $40 billion in private investments will also be needed to complete the projects. If Trump rolls back climate policies, as he did during his last presidency and has vowed to do again, it could lessen demand for hydrogen energy in the U.S., which could scare away the necessary private investors.

“Federal policy plays a critical role in shaping the pace and scale of clean energy adoption,” said Ellet, who oversaw $1 billion in investments across the U.S. for Air Liquide, a partner in six of the seven hubs. “That said, global market dynamics and established corporate commitments continue to offer a solid foundation for sustained private sector investment in clean energy.”

Environmental justice deprioritized

Environmental justice frameworks that aren’t part of legal statutes are some of the easiest targets for elimination.

A prime example is the Biden Administration’s Justice40 initiative, a federal mandate to allocate 40% of federal investments in climate, clean energy, housing, among others, to “disadvantaged communities that are marginalized by underinvestment and overburdened by pollution.”

The federal hydrogen hub networks are one of the first major tests of the Justice40 initiative, but even in pre-development phases advocates and communities shared grievances around community engagement and transparency.

Most recently, advocates were notified just hours before the DOE announcement of phase one funding for the Midwest Hydrogen Hub, according to the advocacy group Just Transition Northwest Indiana. “We were literally in a meeting with DOE and the [Office of Clean Energy Demonstrations] minutes before the announcement was made, with no mention that the award was being dropped today,” the group said in a press release. “We are justifiably stunned to see it suddenly flash over our news feed. We are fed up with the continuous lack of transparency.”

Many worry that these issues will worsen under the Trump administration. Project 2025 — a policy blueprint that Trump distanced himself from on the campaign trail but that now seems central to his Cabinet picks and plans — explicitly calls into question whether the government should be addressing the roles of race and income in pollution exposure, and aims to dismantle the U.S. Environmental Protection Agency.

“A lot of the alarming practices we were seeing under Biden are likely to continue under Trump, if not worsen,” Batoul Al-Sadi, a senior associate at the Natural Resources Defense Council (NRDC), told EHN.

Margaret Cook, deputy director of climate equity and resilience at the Houston Advanced Research Center, said the Center’s position as one the hub’s community engagement partners was finalized last week with phase one awards.

“The contract signed recently with DOE for the first phase includes community engagement,” Cook said. “I can’t speculate about how a new administration would affect the project. Updates to the Justice40 Assessment and Implementation Strategy will be made at the end of each phase, and relevant information will be shared for community input.”

While the future of the hubs’ community engagement and emissions reduction rollout remains unclear until Trump begins his term, out of the four hubs EHN was able to reach none stated concerns for the continuation of their projects.

Trump has also vowed to fast-track industrial development permitting, which could hamper community engagement but help projects get developed faster.

“The incoming administration has clear goals around energy independence, job creation and boosting domestic production … all priorities deeply embedded in the hydrogen hubs,” Ellet said. “I anticipate that there will be continued support for the hubs.”

It’s possible that companies and investors might plan for the longer term by taking climate needs and importance of community buy-in into account even if they aren’t required to by law. During the last Trump presidency, for example, large auto manufacturers including Mercedes-Benz, Honda, Ford, Volkswagen and BMW announced they wouldn’t adhere to the Trump administration’s rollback of emission standards and would instead continue to comply with the previous standards enacted by the Obama administration to reduce planet-warming carbon dioxide emissions.

“We know there’s bipartisan support and that both blue and red states have benefitted from clean energy investments,” Lauren Piette, a senior associate attorney for EarthJustice’s clean energy program, told EHN. “I worry about what the next administration could do with those investments, but my hope is there’s a groundswell of support from members of the public, legislators and policymakers who understand our future runs on clean energy and we need to get there sooner rather than later.”